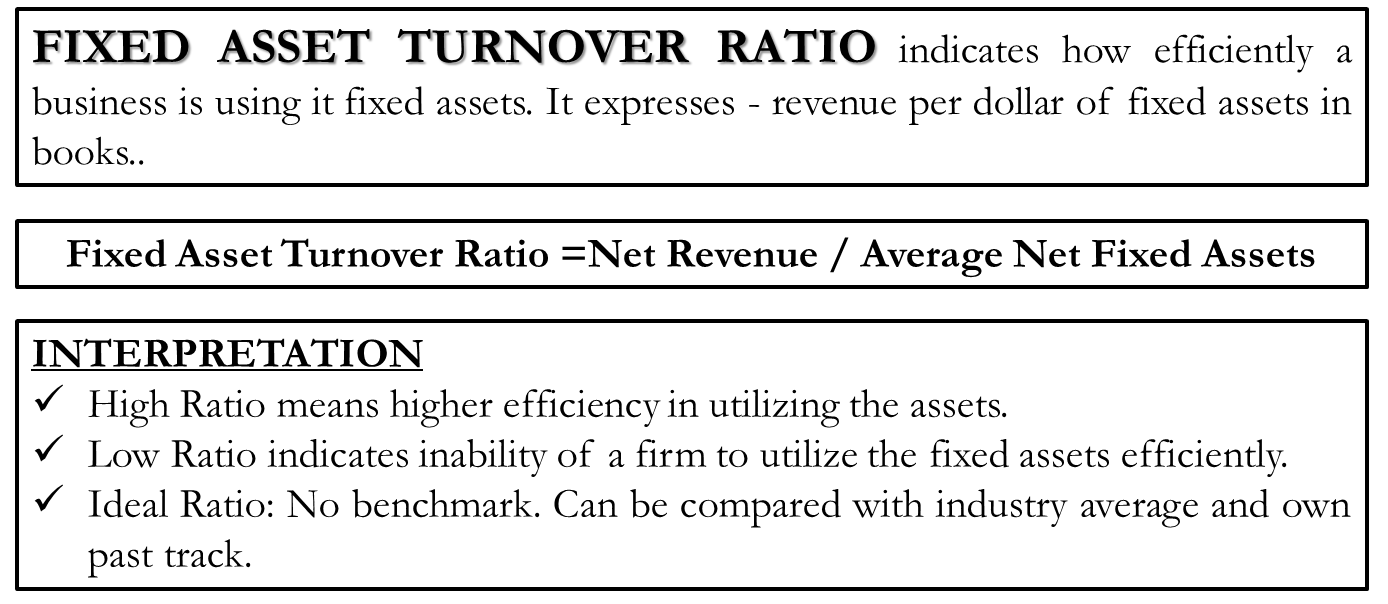

The working capital ratio measures how well a company uses its financing from working capital to generate sales or revenue. This ratio compares net sales displayed on the income statement to fixed assets on the balance sheet. The fixed asset turnover ratio is useful in determining whether a company uses its fixed assets to drive net sales efficiently. It is calculated by dividing net sales by the average balance of fixed assets of a period. The Asset Turnover Ratio is a performance measure used to understand the efficiency of a company in using its assets to generate revenue.

In the final analysis

Asset turnover ratio results that are higher indicate a company is better at moving products to generate revenue. As each industry has its own characteristics, favorable asset turnover ratio calculations will vary from sector to sector. Though ABC has generated more revenue for the year, XYZ is more efficient in using its assets to generate income as its asset turnover ratio is higher.

Ask Any Financial Question

However, it is a closely related metric that can impact profitability, as more efficient use of assets can lead to increased sales and profits. Also, a company’s asset turnover ratio could vary widely from year to year, making it an unreliable measure for potential long-term investments. Even if the ratio has been similar in years past, this doesn’t mean it will continue to remain consistent. However, investors can look at the long term trendline of the ratio to get a general indication of whether it’s improving or not. It is the gross sales from a specific period less returns, allowances, or discounts taken by customers.

How is the asset turnover ratio calculated?

But even if your asset turnover ratio number isn’t where you want it to be, don’t worry—that number isn’t set in stone. If you can make adjustments in your processes to improve that number, that’s great news—it shows that you’re a flexible owner, and can make changes to benefit your business. Total asset turnover ratio should be looked at together with the company’s financing mix and its net profit margin for a better analysis as discussed in DuPont analysis. If a company can generate more sales with fewer assets it has a higher turnover ratio which tells us that it is using its assets more efficiently. On the other hand, a lower turnover ratio shows that the company is not using its assets optimally.

Part 2: Your Current Nest Egg

It provides significant insights into how efficiently a company uses its assets to generate sales. The limitations outlined above play into some of the potential drawbacks of the asset turnover ratio when analyzing stocks, too. Mostly, it comes down to the fact that as a single ratio, which doesn’t reveal the total health or financial picture for a single company. For that reason, it’s probably a good idea to use the ratio in tandem with other analysis tools and methods. Industry averages provide a good indication of a reasonable total asset turnover ratio. Companies with fewer assets on their balance sheet (e.g., software companies) tend to have higher ratios than companies with business models that require significant spending on assets.

- So, you might find that your asset turnover ratio isn’t a totally accurate reflection of your current efficiency.

- For instance, a ratio of 1 means that the net sales of a company equals the average total assets for the year.

- Since the total asset turnover consists of average assets and revenue, both of which cannot be negative, it is impossible for the total asset turnover to be negative.

After all, the main reason for holding an asset is to help the company achieve a certain level of sales. A system that began being used during the 1920s to evaluate divisional performance across a corporation, DuPont analysis calculates a company’s return on equity (ROE). As everything has its good and bad sides, the asset turnover ratio has two things that make this ratio limited in scope. Of course, it helps us understand the asset utility in the organization, but this ratio has two shortcomings that we should mention. If you want to compare the asset turnover with another company, it should be done with the companies in the same industry.

For instance, other ratios that can be used to gain an understanding of a company’s financials are the debt-to-equity ratio, its P/E ratio, and even looking at its net asset value. For Year 1, we’ll divide Year 1 sales ($300m) by the average between the Year 0 and Year 1 PP&E balances ($85m and $90m), which comes out to a ratio of 3.4x. To reiterate from earlier, the average turnover ratio varies significantly across different sectors, so it makes the most sense for only ratios of companies in the same or comparable sectors to be benchmarked. The turnover metric falls short, however, in being distorted by significant one-time capital expenditures (Capex) and asset sales. Hence, it is often used as a proxy for how efficiently a company has invested in long-term assets.

So from the calculation, it is seen that the asset turnover ratio of Nestle is less than 1. We have discussed how you would be able to calculate the asset turnover ratio and would also be able to compare among multiple ratios in the same industry. Additionally, there are other metrics by which to evaluate a company or value its stock. As always, speak with a financial seek bromance professional if you feel like you’d benefit from more guidance. Conversely, a number less than 1 means that assets are generating less than the amount of their dollar value. If a company isn’t effective at generating sales with its assets, it most likely wouldn’t be a great investment — which, again, is important to know if you’re building an investment portfolio.

To get a true sense of how well a company’s assets are being used, it must be compared to other companies in its industry. This ratio measures how efficiently a firm uses its assets to generate sales, so a higher ratio is always more favorable. Higher turnover ratios mean the company is using its assets more efficiently.

Companies with cyclical sales may have low ratios in slow periods, so the ratio should be analyzed over several periods. Additionally, management may outsource production to reduce reliance on assets and improve its FAT ratio, while still struggling to maintain stable cash flows and other business fundamentals. Rather, in that case, we need to find out the average asset turnover ratio of the respective industries, and then we can compare the ratio of each company. In the realm of financial analysis, the Asset Turnover Ratio plays a critical role.