Consequently, it allows them to decide how much to charge for said service. As technology and innovative processes continue to evolve the construction industry, the need for openness and collaboration among teams and stakeholders has increased significantly. Job costing boosts client confidence by what is the margin of safety formula delivering projects on time and under budget. Being transparent with your costing builds trust and leads to higher client satisfaction and repeat business. This guide covers everything you need to know about job costing—what it is, why it’s important, how to implement it, examples, and much more.

- If you’re doing this manually, then it can mean endless spreadsheets and lots of last-minute shift swapping.

- At its core, it includes several key components that collectively provide a clear picture of the costs incurred.

- The total cost of your firm’s billable labor hours is $20,000 and you will bill $2,500 in material costs.

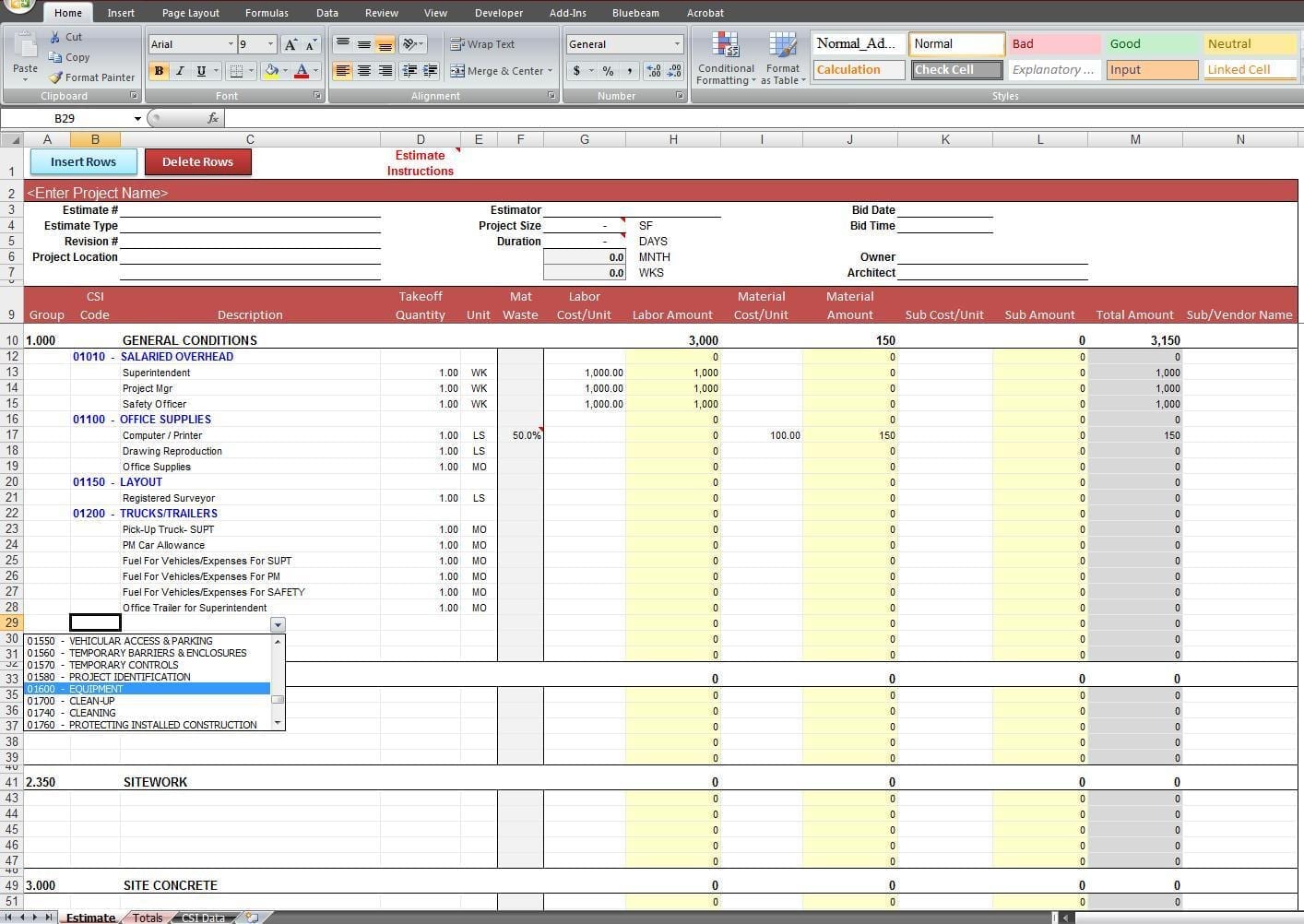

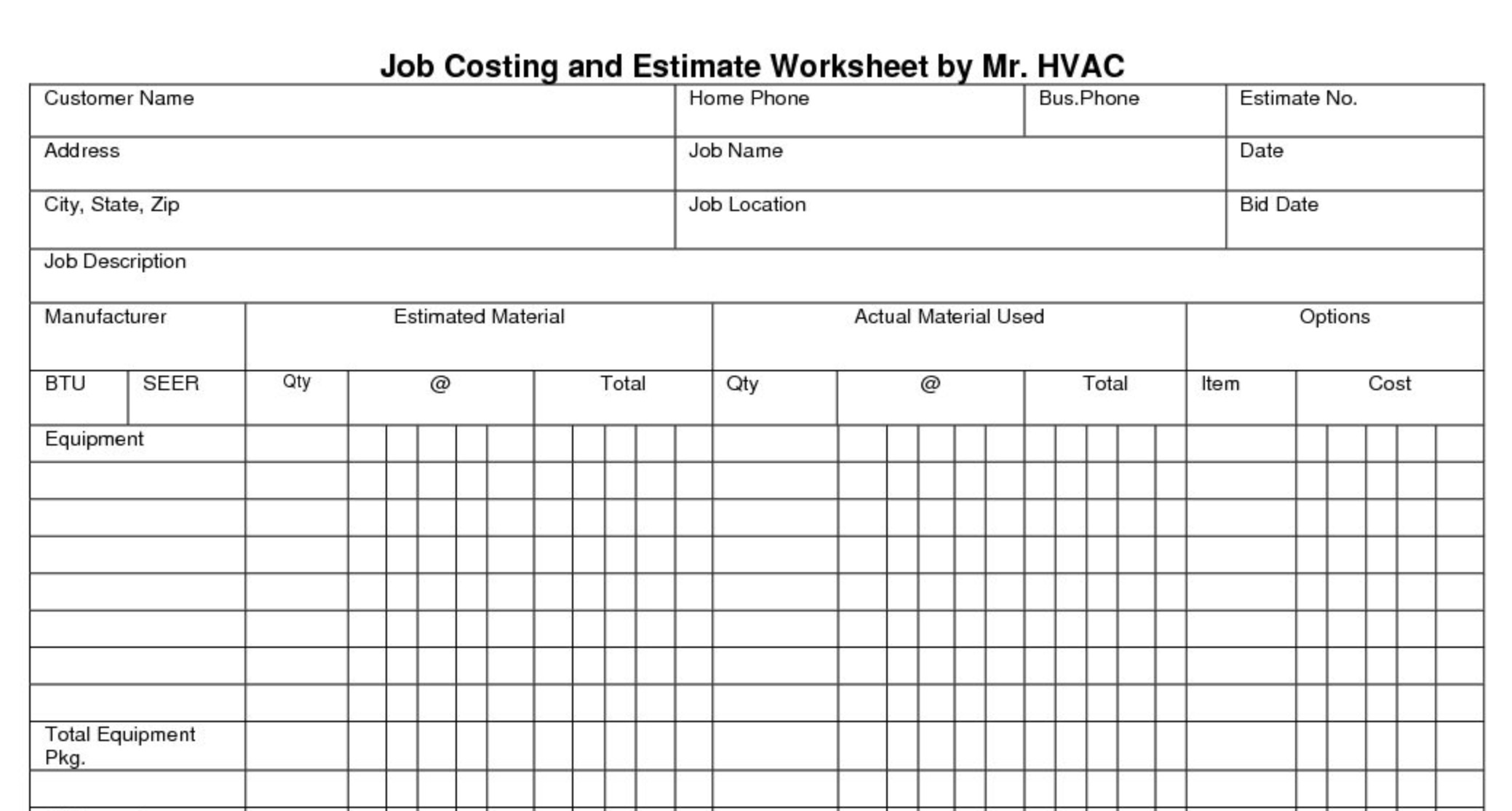

- Enter category and items, projected and actual costs, responsible parties, status, and percentage of each task complete.

- Job costing, also called project-based accounting, is the process of tracking costs and revenue for each individual project.

tips for more accurate job costing

By analyzing variances between planned and actual costs, these businesses can identify areas for enhancement, refine budgeting strategies, and enhance overall project management practices. In essence, job cost sheets empower small businesses to navigate the complexities of project finances, fostering efficiency, transparency, and strategic decision-making. As we have already mentioned, each job order in a job order costing system has its own job cost sheet. And that cost usually breaks down in terms of direct labor, direct materials, and manufacturing or service overhead. Use this comprehensive software project costing template to calculate costs for your software projects. Use the Estimation Variables section to factor in all project management and project control efforts, and compare estimated and actual hours for each phase of your software project.

Why would a company use job order costing instead of process costing?

This historical data serves as a benchmark, allowing businesses to identify trends and patterns in their spending. Direct labor costs encompass the wages and benefits of employees who are directly involved in the production of goods or the execution of a project. These costs are straightforward to trace to a specific job, as they involve workers who are actively engaged in the creation of the product or service. For instance, in a custom software development project, the salaries of the developers and testers would be classified as direct labor.

Do you already work with a financial advisor?

This precise tracking allows businesses to monitor material usage closely, helping to identify any wastage or inefficiencies. By maintaining detailed records of direct materials, companies can also negotiate better pricing with suppliers and ensure that they are not overstocking or understocking essential items. A job cost sheet is a detailed breakdown of the actual and estimated costs involved in producing a particular product or completing a specific job (e.g., materials, equipment, labor, and others). It’s used primarily by the manufacturing and construction industry for tracking and managing costs, ensuring accurate cost estimation, effective cost control, and informed decision-making.

Granular Tracking of Expenses

Costing sheets facilitate the comparison of estimated costs with actual costs incurred throughout a project. This enables project managers to identify variances and take corrective actions if necessary. By regularly updating and analyzing the costing sheet, project managers can maintain tighter control over project budgets and profitability. The key difference is that job costing tracks expenses for a project, like building a house, whereas process costing tracks expenses for each stage of production for mass-produced items. In process costing, costs are recorded for each stage of production and then averaged over the total number of products to determine the cost per unit. To simplify and improve your job costing calculations, consider using an expense tracking software like Fyle or an accounting software with job costing.

Allocate costs.

By looking back at past estimates and comparing them to actual costs, you can make more accurate estimates when planning for a similar project. Job costing can help managers identify inefficiencies and excess costs that can be addressed by automating work or allocating resources better. This is done to evaluate the overall profitability of the type of work that was done and to determine if there are any areas where costs could be cut in the future.

Job costing provides a clear view of all the direct and indirect costs and how they affect the budget. It also gives you a better idea of the potential risks, allowing for proactive management. This leads to fewer financial surprises and better handling of unforeseen issues. In job costing, the cost is maintained for each job or product by calculating all expenses, including materials, labor, and overheads. Understanding how to effectively use job cost sheets can lead to more informed decision-making and better resource allocation. Another difference is that costs can’t be transferred in job costing, but that can be across processes in process costing.

This takes us back to the discussion we had at the very beginning of this blog, and that will explain the perils of such mistakes. With its easy scheduling and automated timesheets and payroll, ZoomShift is the ideal tool to help you perfect your job costing. If you don’t have a clear picture of how you’ll need to deploy your workforce, then it’s hard to understand what expenses you’ll incur. In many industries where job costing takes place, it’s important to have the right mix of people working at any given time.