Funding liquidity pertains to the availability of credit or funding for institutions, particularly financial ones like banks. In contrast, those with minimal liquidity might be compelled to seek costly external financing or make unfavorable decisions under duress. Our writers and editors used an in-house natural language generation platform to assist with portions of this article, allowing them to focus on adding information that is uniquely helpful.

Related AccountingTools Courses

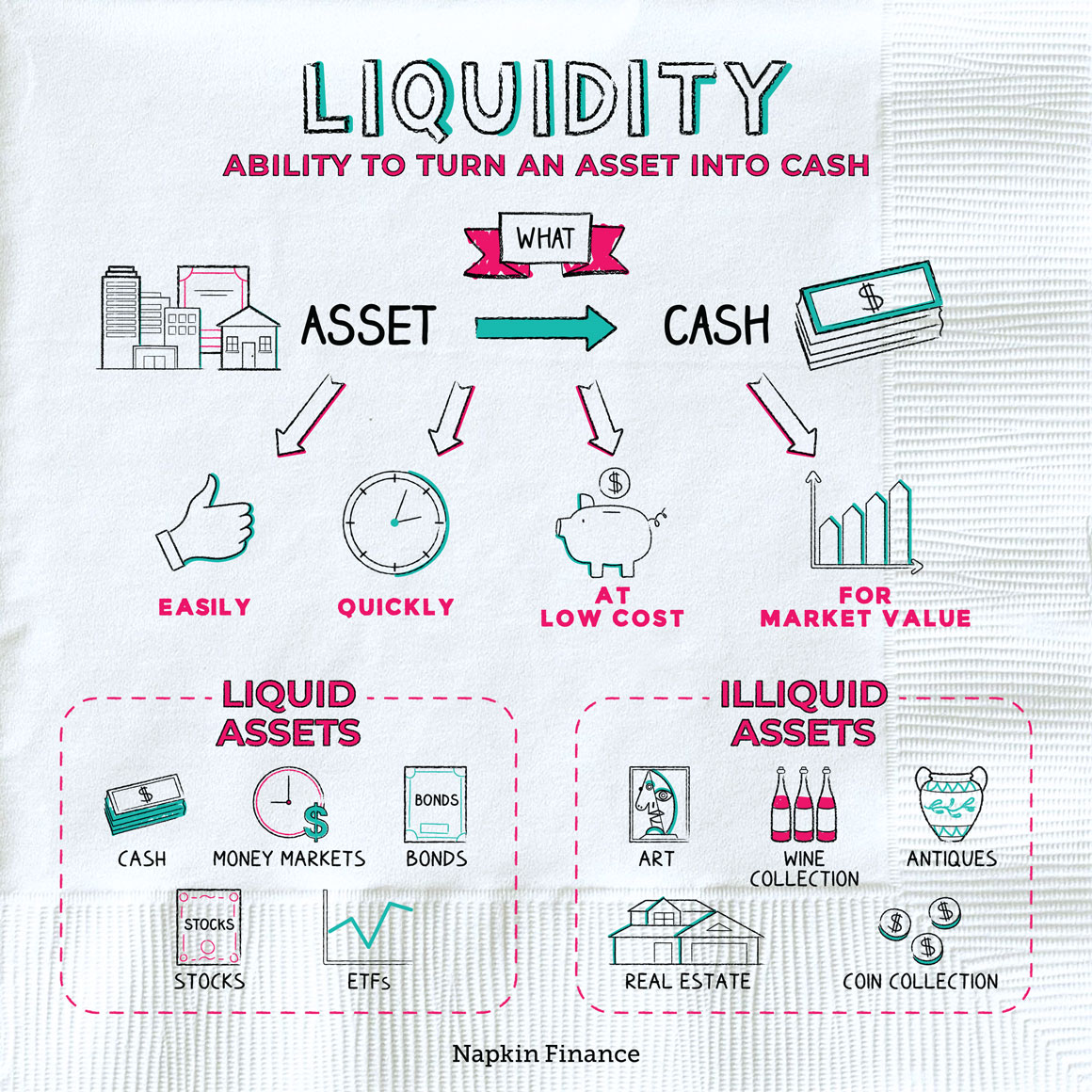

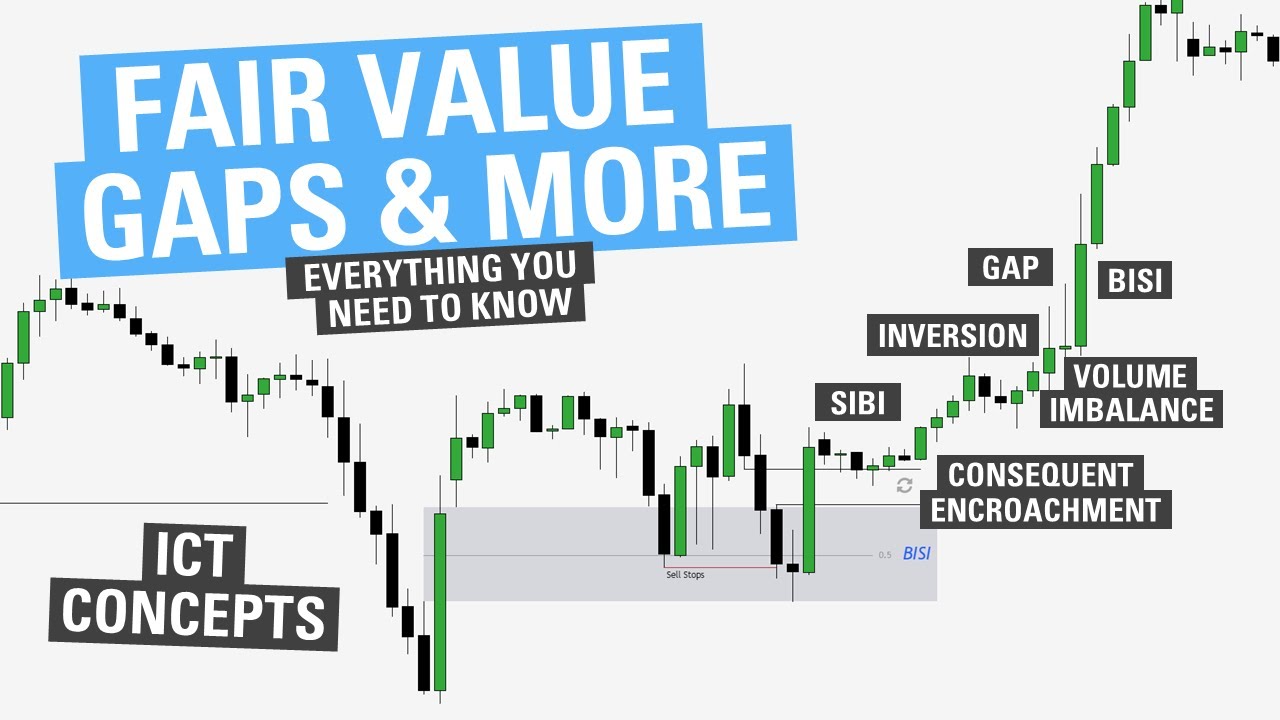

It represents the ease with which an asset can be converted into cash or used to make transactions. Assets with high liquidity are easily tradable, while those with low liquidity may encounter challenges in finding buyers or sellers at a desired price. In this visualization, we can see how an aggregated orderbook brings together pricing and volume from multiple exchanges (shown in blue) into a single source (shown in green). Each exchange broadcasts their best bid and ask prices along with available volume, which flows continuously into the central aggregator. The aggregator then combines this information to create the most competitive pricing possible – in this example, finding the best bid at $42,350 and best ask at $42,400, creating a tight $50 spread. This process happens in real-time, ensuring traders always see the true best prices available across the entire market rather than being limited to a single exchange’s liquidity.

Quick Ratio (Acid-Test Ratio)

- While these assets may not be easily converted into cash, they still hold value and play a crucial role in the financial stability of a company.

- Your other fixed assets that lack physical substance are referred to as intangible assets and consist of valuable rights, privileges or advantages.

- Naturally, cash is the most liquid asset, whereas real estate and land are the least liquid asset, as they can take weeks, months, or even years to sell.

- Financial institutions also rely on liquidity to meet their short-term obligations and manage liquidity risk.

- The pooling of liquidity through aggregated order books offers unique advantages to both traders and exchanges.

This multi-exchange approach means that instead of being limited to one source’s buy and sell orders, traders see a unified list of bids and asks from across the ecosystem. This depth allows for better price visibility and more trading options, as the consolidated data provides access to a broader range of prices at each level. Accounting liquidity refers to the ability of a company or individual to meet their short term debt obligations with the assets they have at hand. You can convert Liquid assets to cash easily, such as cash itself, accounts receivable, and marketable securities.

The order of liquidity is typical: cash, fixed assets, liquid assets, and non-liquid assets

For example, a company that relies on inventory would have a different order of liquidity than a company that relies on receivables. The Biden administration already has in place a number of bans on the export of AI chips and models. However, some Chinese firms are reportedly using loopholes to access the tools through cloud services. Some Republicans have said that they want NIST to focus on AI’s physical safety risks, including its ability to help adversaries build bioweapons (which Biden’s EO also addresses).

Conversely, illiquid assets may restrict investors’ ability to buy or sell at desired prices, potentially leading to delays in executing trades or incurring higher transaction costs. When a stock has high volume, it means that there are a large number of buyers and sellers in the market, which makes it easier for investors to buy or sell the stock without significantly affecting its price. On the other hand, low-volume stocks may what does order of liquidity mean be harder to buy or sell, as there may be fewer market participants and therefore less liquidity. Accounting liquidity measures the ease with which an individual or company can meet their financial obligations with the liquid assets available to them—the ability to pay off debts as they come due. It plays a crucial role in business valuation by reflecting factors such as brand reputation, customer loyalty, and market positioning.

Definitions of related terms

One way to measure a firm’s ability to meet its short-term obligations with its liquid assets. Balance sheet liquidity is a measure of a company’s ability to meet its financial obligations with its liquid assets. Aggregated order books are changing the face of crypto trading by bringing together liquidity from multiple exchanges in one place. This approach allows traders to access better pricing, smoother execution, and broader market depth, while exchanges benefit from increased trading activity and a steadier market.

But they’ve also shied away from endorsing new restrictions on AI, which could jeopardize portions of NIST’s guidance. AI Safety Institute (AISI), a body to study risks in AI systems, inclusive of systems with defense applications. It also released new software to help improve the trustworthiness of AI, and tested major new AI models through agreements with OpenAI and Anthropic. The other provision directs the Commerce Department’s National Institute of Standards and Technology (NIST) to author guidance that helps companies identify — and correct for — flaws in models, including biases. It denotes an entity’s ability to secure immediate financing without resorting to desperate measures or selling assets at a steep discount.

With a uniform listing criterion established by an accounting GAAP, it becomes easier for various stakeholders to understand, analyze the company’s balance sheet and make decisions accordingly. Exchanges benefit from pooled liquidity by attracting a more diverse range of traders, including those who value deeper liquidity for executing higher volumes. A more active order book can increase trading volume, providing a consistent flow of orders and making the exchange a competitive choice for users. When exchanges collaborate to share liquidity, they contribute to a stable market environment that reduces the volatility often caused by limited orders. This setup is mutually beneficial, supporting both smooth trading for users and stronger performance for the exchange itself. Unlike standard order books, which only show orders on a single exchange, aggregated order books combine data from multiple platforms, creating a comprehensive view of the market.

Among the most conservative liquidity measures, the cash ratio is determined by dividing a company’s cash and cash equivalents by its current liabilities. The current ratio, calculated as a company’s current assets divided by its current liabilities, is a popular metric to gauge a company’s financial health in the short term. You can turn these investments into cash, but the process can take months or years and usually involves a number of other costs such as realtor commissions and closing costs. Cash is the most liquid asset, followed by cash equivalents such as Treasury bills, Treasury notes and certificates of deposit (CDs) with a maturity of three months or less. A CD with a longer timeline than three months can still be considered liquid if you’re willing to pay the penalty to access the funds before the maturity date.

It gives an insight into how well a company can meet its short-term liabilities and continue operations without any interruptions. First and foremost, liquidity plays a pivotal role in facilitating the smooth operation of financial markets. It enables market participants to swiftly buy and sell assets, thereby ensuring the seamless flow of capital and the efficient allocation of resources. A liquid market fosters price transparency, as assets can be traded at prevailing market prices without substantial price fluctuations, promoting fair and equitable transactions.